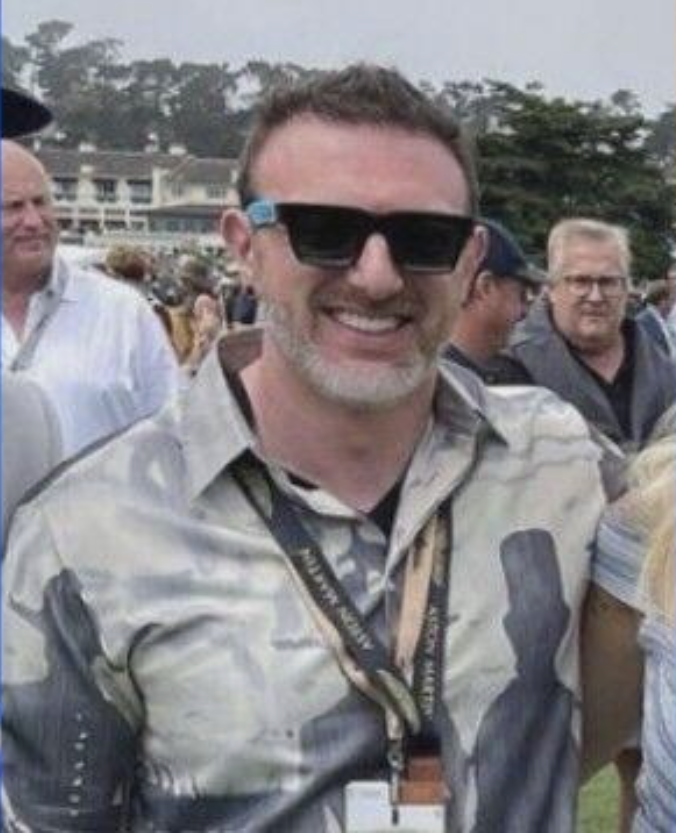

If you’re into sneakers these days, you know the game has changed a lot. There are plenty of highly coveted sneakers, but these days you must compete for the chance to buy many popular pairs. Michael Malekzadeh, 39, of Eugene, OR, seemed to be the ultimate plug for many through his Zadeh Kicks. His company would often offer highly sought-after pairs of sneakers at a lower price point than the sources. However, he found himself in hot water this spring when it was revealed that he owed customers millions of dollars worth of unfulfilled orders. Malekzadeh’s alleged swindling has earned him the title “The Bernie Madoff of sneakers.”

Yesterday (August 3), Malekzadeh pleaded not guilty to wire fraud, conspiracy to commit bank fraud, and money laundering in federal court. His fiance, Bethany Mockerman, was also charged with conspiring with Malekzadeh to commit bank fraud. She, too, pleaded not guilty.

The Department of Justice press release reads:

According to court documents, Malekzadeh started his business in 2013 by purchasing limited edition and collectible sneakers to resell online. Beginning as early as January 2020, Zadeh Kicks began offering preorders of sneakers before their public release dates, allowing Malekzadeh to collect money upfront before fulfilling orders. Malekzadeh advertised, sold, and collected payments from customers for preorders knowing he could not satisfy all orders placed.

An example of these alleged shady practices would be Malekadeh’s sale of Air Jordan Cool Grey XI, released in December 2021. While Nike listed pairs of the high-top sneakers with a nubuck upper and gray mudguard at $225, Zadeh Kicks had them for as low as $115. Through preorders, Zadeh Kicks sold 600,000 pairs of the Jays and collected $70 million. The problem was that nobody could feasibly get that many of that sneakers. To put it in perspective, Nike only produced one million pairs of Cool Grays that go round. In fact, Malekzadeh could only get his hands on 6,000 pairs, thus leaving scores of customers hanging.

Many of Zadeh Kicks’ customers who got shafted on their orders this way were promised millions in undelivered cash refunds or store credit (which was ultimately worthless). Some customers were owed thousands. One anonymous New York buyer claims to be owed $42,000.

However, in this case, the most severe charge is conspiracy to commit bank fraud, which carries a maximum of 30 years in prison. Malekzadeh and Mockerman stand accused of falsifying bank documents on more than 15 loan applications to financial institutions, and the couple reaped $15 million off those applications.

Malekzadeh didn’t let his allegedly bilked fortune go to waste, and he spent the money on the best money could buy, which is now state property. According to the feds:

As part of the government’s ongoing criminal investigation, federal agents have seized millions of dollars in cash and luxury goods that Malekzadeh acquired with the proceeds of his fraud. The seized items include nearly 100 watches, some valued at over $400,000, jewelry, and hundreds of luxury handbags. The government also seized nearly $6.4 million in cash which was the result of Malekzadeh’s sale of watches and luxury cars manufactured by Bentley, Ferrari, Lamborghini, Porsche, and others.

As stated before, if convicted of the most serious crime– conspiracy to commit bank fraud– Malekzadeh is looking at a maximum of 30 years behind bars, a $1 million fine and five years of supervised release. A maximum penalty of 20 years in prison, a fine of up to $250,000, and three years of supervised release come with a wire fraud conviction. Money laundering carries a maximum penalty of 10 years in prison, a $250,000 fine, and three years of supervised release.

“He has consistently taken full responsibility for his actions and will continue to do so,” said Malekzadeh’s attorney Perini-Abbott in a written statement. “He has cooperated fully with the federal government and the receiver from day one because his primary goal is to minimize the financial harm to his customers and other interested parties. “